Bitcoin covers several interdependent dimensions that it is crucial to distinguish in order to understand how it works. Terminological vagueness, often maintained by everyday language, interferes with rigorous analysis. Here we propose to separate the main constituent levels of the system:

- Bitcoin (with B) : the global system — protocol, network, infrastructure, and monetary unit.

- Bitcoin (BTC) : the unit of account, the protocol's native digital currency.

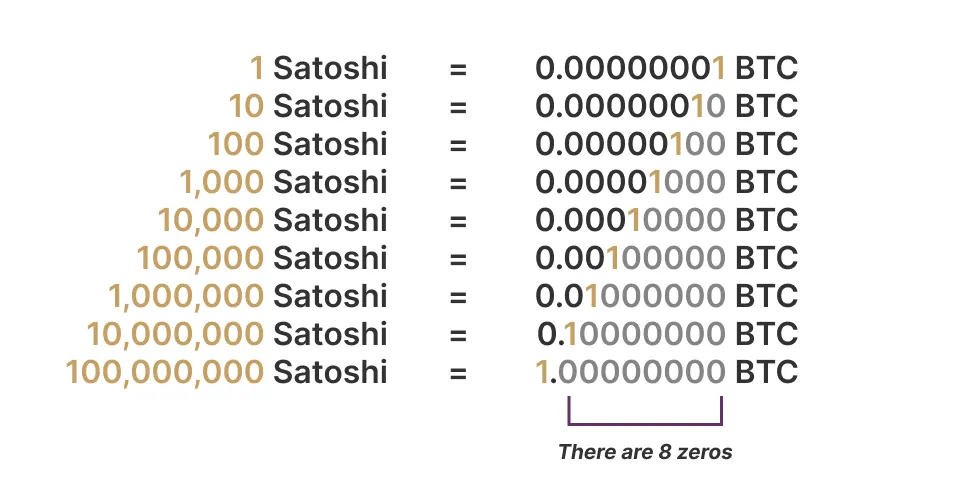

- Satoshi : the smallest subdivision of a bitcoin.

- Bitcoin Token : a misnomer, because Bitcoin is not a token issued, but a registry unit.

- Bitcoin protocol : the set of open source software rules that define the system.

- Bitcoin network : all the nodes running the protocol, validating and relaying the transactions.

- Bitcoin infrastructure : the hardware, software, and energy elements that support the system.

1. Economy, Money, and Capital

- ATH (All-Time High): Highest price level ever achieved by a given asset.

- Bitcoin (BTC) : Digital currency, decentralized, limited to 21 million units. It is a rare, secure asset, with no trusted third party.

- Fiat (fiat currency) : Traditional currency (euro, dollar, etc.), created by central banks, without being backed by a tangible asset.

- Bitcoin Standard : Reference to an economic system where Bitcoin is used as a monetary base, as opposed to the fiat standard.

- Satoshi : The smallest unit of Bitcoin. 1 BTC = 100,000,000 satoshis.

- Store of value : An asset that allows you to maintain your purchasing power over time (gold, real estate, Bitcoin).

- Inflation : A general rise in prices, which reduces the purchasing power of a currency.

- Halving : An event that halves the reward for minors every 4 years. This decreases the issuance of new bitcoins.

- Bear Market : A prolonged period of falling prices on the markets.

- Bull Market : A prolonged period of rising prices.

- Genesis Block : First block of the Bitcoin blockchain, mined on January 3, 2009 by Satoshi Nakamoto. It contains a reference to the 2008 banking crisis.

- Block Time : Average time to produce a new block on the Bitcoin blockchain: around 10 minutes.

2. Technology and operation

- Blockchain : Public, decentralized ledger, where all Bitcoin transactions are recorded.

- Mining : A process that secures the Bitcoin network and validates transactions, in exchange for a bitcoin reward.

- Miner : Bitcoin network participant who uses computing power to secure the network and earn bitcoins.

- PoW (Proof of Work) : Validation system used by Bitcoin. It requires an expenditure of energy to validate a block.

- PoS (Proof of Stake) : An alternative system to PoW, used by other cryptocurrencies. It is based on possession (stake) rather than energy.

- Hash : Result of a cryptographic operation. It makes it possible to identify a block or a transaction in a unique way.

- Seed phrase : A sequence of 12 or 24 words that allows you to restore a Bitcoin wallet. Never share it.

- Wallet : An application or device for storing, sending, and receiving bitcoins.

- Private key : Secret code that gives access to your bitcoins. Whoever has the private key owns the funds.

- Public key/Bitcoin address : Code that you can share to receive bitcoins.

.png)

3. Transactions and sovereignty

- Hot wallet : Offline wallet (cold) or online wallet (hot), depending on the level of security and accessibility.

- Layer 1/Layer 2 : Layer 1: main blockchain (Bitcoin, Ethereum). Layer 2: solution built on top of it to improve scalability.

- Gas fees : Transaction fees on some blockchains (especially Ethereum).

- Fork : Modification of the blockchain protocol that can create a new version of the network (soft fork/hard fork).

- Node : Computer participating in the network, storing and validating blockchain data.

- On-chain transaction : Transaction recorded directly on the Bitcoin blockchain.

- Transaction Lightning : Instant and almost free payment via the Lightning Network, outside of the main blockchain.

- Lightning Network : A fast and scalable payment system built on top of Bitcoin.

- Custodial wallet : Wallet whose private keys are held by a third party (e.g. platform).

- Non-custodial wallet : Wallet that only you hold the keys to. It is the most sovereign form of detention.

- “Not your keys, not your coins” : If you don't have the private keys, you don't really own your bitcoins.

4. Regulation and compliance

- KYC (Know Your Customer) : User identification procedure imposed on service providers.

- AML (Anti-Money Laundering) : Fight against money laundering, often combined with KYC.

- VASP (Virtual Asset Service Provider) : Provider of services related to cryptoassets (exchanges, wallets, etc.).

- MiCA (Markets in Crypto-Assets) : European regulation harmonizing the legal framework for cryptoassets in the EU.

- Whitepaper : Document presenting the project, protocol and economic model of a crypto asset.

- Security token : Token representing a financial security (shares, bonds, etc.), subject to financial market regulation.

- Utility token : Token giving access to a service in a given ecosystem.

- Travel rule : Obligation for crypto providers to share certain user information during fund transfers.

- FATF/GAFI : International organization defining standards against money laundering and the financing of terrorism.

5. Culture, vision and strategy

- Hard money : Currency that is difficult to create or dilute. Bitcoin is designed as “hard money.”

- Soft Money : Easily issued currency (ex: fiat currency).

- Financial sovereignty : Ability to manage, secure and transmit one's assets without depending on a bank or a State.

- Strategic reserve : An asset owned by a state or a company to withstand crises (Bitcoin is beginning to be integrated into it).

- Decorated : An asset is decorrelated when it does not follow traditional markets (shares, bonds, etc.).

Our Blog

Discover our educational articles, practical guidance, and crypto news to help you better understand, secure, and grow your digital assets.